oklahoma franchise tax phone number

Eligible entities are required to annually remit the franchise tax. Visit Us on the Web.

Bojangles Chicken And Biscuits Breakfast Biscuits Food Signs

In Oklahoma the maximum amount of franchise tax a corporation can pay is 20000.

. First Name Middle Initial Last Name Social Security Number Home Address street and number Daytime Phone area code and number City State or Province Country Postal Code Title 2. 1 Toll Free Phone Sales Tax Department. Oklahoma Tax Commission PO Box 26850 Oklahoma City OK 73126-0850 Local Phone Sales Tax Department.

Oklahoma Tax Commission Franchise Tax Post Office Box 26930 Oklahoma City OK 73126-0930 Phone Number for Assistance 405 521-3160 Mandatory inclusion of Social Security andor Federal Employers Identification numbers is required on forms filed with the Oklahoma Tax Commission pursuant to Title 68 of the Oklahoma Statutes and regula-. Oklahoma Tax Commission all past franchise returns must be filed and there may be no outstanding franchise tax liabilities. Ment made payable to Oklahoma Tax Commission balance sheet and schedules A B C and D.

Oklahoma Tax Commission Franchise Tax Post Office Box 26920 Oklahoma City OK 73126-0920 Phone Number for Assistance 405 521-3160 Mandatory inclusion of Social Security andor Federal Employers Identi-. Oklahoma Tax Commission with each report submitted. I will include franchise tax information on the Oklahoma Corporate Income Tax Form 512 or 512-S.

For additional assistance please contact the agency at 405-521-3160. Click Here to Start Over. Please put your FEIN on your check.

I elect to file one return for both franchise and corporate income taxes. Please put your FEIN on your check. Oklahoma Tax Commission with each report submitted.

Corporations reporting zero franchise tax liability must still file an annual return. Do not fold staple or paper clip Detach Here and Return Voucher with Payment Do not tear or cut below line. I understand that by.

Who to Contact for Assistance For franchise tax assistance call the Oklahoma Tax Commission at 405 521-3160. Sales Tax Exemption Motor Vehicle Exemption Ad Valorem Exemption E-File Free File Businesses Tax Types Income Tax Corporate Sales Use Withholding Alcohol Tobacco Miscellaneous Business Sales Tax Business Use Tax Business Motor Fuel. The in-state toll free number is 800 522-8165.

If you are a new business register online with the Oklahoma Employer Security Commission to retrieve your Account. Press 0 to speak to a representative. Complete Form 512-FT Computation of Oklahoma Consolidated Annual Franchise Tax to determine the combined taxable income to report on page 2 Section Two lines 1825.

The following is the Tax Commissions mission statement as it exemplifies our direction and focus. Who to Contact for Assistance For franchise tax assistance call the Oklahoma Tax Commission at 405 521-3160. Oklahoma Tax Commission Payment Center.

Oklahoma Employer Account Number and Tax Rate. We would like to show you a description here but the site wont allow us. Oklahoma City OK 73126-0890 Do not enclose a copy of your Oklahoma tax return.

You will be automatically redirected to the home page or you may click below to return immediately. General Oklahoma Tax Commission Address. The franchise tax applies solely to corporations with capital of 201000 or more.

If you already have a Withholding Tax Account ID you can find this number on correspondence from the Oklahoma Tax Commission. Mandatory inclusion of Social Security andor Federal Employers Identification numbers is required on forms filed with the Oklahoma Tax. With the reorganization of the Oklahoma Tax Commission in 1995 came the refocus of the Tax Commissions goals and objectives.

Oklahoma Annual Franchise Tax Return Page 2 FRX200 Taxpayer Name FEIN Account Number 1. Youll find a wealth of information on our web- site including downloadable taxformsanswersto common questions and online filing options forboth income and business taxes. First Name Middle Initial Last Name Social Security Number.

Returns should be mailed to the Oklahoma Tax Commission PO Box 26800 Oklahoma City OK 73126-0800. And interest for late payments of franchise tax 100 of the franchise tax liability must be paid with the extension. If filing a Consolidated Franchise Tax Return for Oklahoma the Oklahoma franchise tax for each corporation is computed separately and then combined for one total tax.

Mandatory inclusion of Social Security andor Federal Employers Identification numbers is required on forms filed with the Oklahoma Tax. If you are the Master logon and have cancelled your own online access you will need to contact.

What Is Franchise Tax Legalzoom Com

Powers Design Build Llc Is A Pioneer In Quality Home Building And Remodeling In Tulsa And Northeast Oklahoma Building A House Design Industrial Buildings

Yahoo Sports Nfl Nfl Teams Logos Nfl Teams Team Emblems

Titans Bandwagon Guide Music City Miracle Moving To Tennessee Music City

Pin By Jennifer Vaudrain On Life Hacks Credit Repair Business Credit Repair Companies Credit Repair Letters

Mba Essay Sample Insead In 2021 Essay Samples Narrative Writing Essay

Pin By 49er D Signs On 49er Logos San Francisco 49ers Football Nfl Football 49ers 49ers Football

Cafe For Sale In Taguig Philippines Franchised 4 Small Cafe Outlets And Master Franchise License Of Global Bubble Tea Brand Is For Sale Tea Brands Taguig Bubble Tea

What Is Franchise Tax Overview Who Pays It More

Free Grant Of Right To Use 2 Form Printable Real Estate Forms Real Estate Forms Reference Letter Words

Oklahoma Tax Commission Facebook

Get Wonderful Suggestions On Travel Trailers They Are Actually Offered For You On Our Site Classic T Shirts T Shirt The Martian

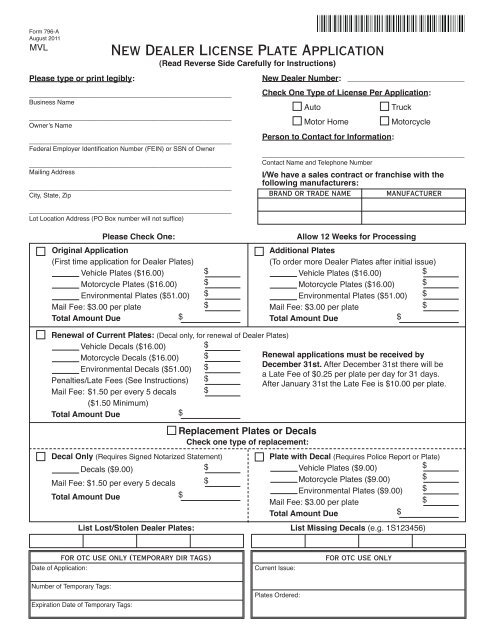

New Dealer License Plate Application Oklahoma Tax Commission

Oklahoma Tax Commission Facebook

Nfl Nike Dunk Shoes Http Www Lowdowndeal Net Nfl Shoes 49er Shoes Nike Nfl